Dubai’s property market is once again the talk of global real estate circles. Towering skyscrapers, luxury villas, and exclusive waterfront developments are changing hands at dizzying prices, attracting wealthy investors from across the world. Yet, beneath the glittering skyline and record-breaking sales, experts are voicing concerns that the emirate’s latest housing boom may be laying the groundwork for another sharp correction.

The Market’s Meteoric Rise

Over the past three years, Dubai has experienced one of the fastest property price increases in its history. According to industry reports, luxury real estate prices have soared by more than 50% since 2021, with prime areas such as Palm Jumeirah, Downtown Dubai, and Dubai Marina commanding staggering premiums. Demand has been fueled by a combination of ultra-high-net-worth individuals relocating from Europe, Asia, and Russia; a surge in corporate relocations; and the emirate’s reputation as a tax-friendly, business-oriented haven.

Developers are racing to launch new projects, from branded residences with five-star hotel services to sprawling beachfront villas. Pre-sales for some luxury developments have sold out within hours, and real estate agents report intense bidding wars among buyers — a sign that speculative behavior is once again taking root.

Drivers Behind the Frenzy

Several factors have converged to push Dubai’s property market into overdrive:

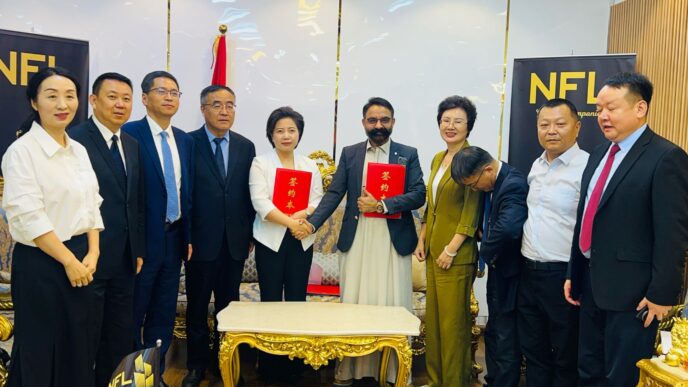

- Foreign Capital Inflows: Wealthy investors from Russia, India, China, and Europe are moving funds into Dubai’s real estate market as a safe-haven play amid global instability.

- Post-Pandemic Migration: Dubai’s liberal visa reforms, including the 10-year “Golden Visa,” have made it easier for investors and entrepreneurs to settle.

- Strong Tourism Recovery: The city’s post-COVID tourism rebound has been one of the fastest in the world, driving demand for short-term rentals and boosting yields for landlords.

- Limited Land in Prime Locations: Areas like Palm Jumeirah and Jumeirah Bay Island remain in short supply, pushing buyers to pay a premium.

Warning Signs Emerge

Despite the bullish mood, analysts are warning that the rapid price acceleration could lead to overheating. This wouldn’t be the first time Dubai’s property sector faced a painful downturn — the market collapsed in 2009 after a speculative bubble burst, and again in 2014-2015 amid oversupply and declining oil prices.

Signs of potential trouble include:

- Rising Speculation: Off-plan flipping is becoming more common, with some investors selling before completion for quick profits.

- Global Economic Risks: Rising interest rates globally, geopolitical tensions, and slowing economic growth could dampen foreign investor appetite.

- Affordability Issues: Middle-class buyers are increasingly priced out, raising concerns about sustainable end-user demand.

- Oversupply Risks: While prime locations remain scarce, the broader market could face excess inventory if developers overbuild.

Government’s Stabilizing Measures

Authorities have taken steps to prevent a repeat of past bubbles. Dubai’s Land Department has tightened regulations on speculative buying, increased transparency in transactions, and monitored project launches closely. Mortgage caps and higher transaction fees have also been introduced in recent years to curb excessive leverage.

However, these measures may face challenges as foreign cash buyers — who are not affected by higher interest rates — dominate the luxury segment.

A Delicate Balancing Act

For now, Dubai remains a magnet for global capital. The city’s status as a luxury lifestyle hub, low-tax environment, and geopolitical neutrality continue to draw in the world’s wealthy. Yet, history suggests that unchecked exuberance can quickly reverse, leaving late entrants exposed to sharp losses.

If Dubai’s housing market continues on its current trajectory, the emirate will need to carefully balance growth with sustainability to avoid a crash that could ripple across its broader economy. The challenge for policymakers, developers, and investors alike is to ensure that the glitter of today’s boom doesn’t blind them to tomorrow’s risks.